Toronto, Ontario, February 5th, 2025 - Realtors® in Toronto, The GTA, and The Golden Horseshoe / Greater Golden Horseshoe Regions of South-Central Ontario today released MarketWatch - the Toronto Regional Real Estate Board’s [TRREB] monthly residential MLS® sales & inventory stats for the first month of 2025.

MLS® sales & inventory stats for the first month of 2025.

All in all, we think this is a pretty positive report, particularly considering the rather extreme levels of uncertainty in many areas - not the least of which are our recently called “snap” provincial election, the imminent federal election, the federal Liberal leadership vote, myriad other economic and political tensions virtually world-wide… oh, yeah - and you-know-who who’s running the show - with a sweeping majority not less - south of the 49th. Our BFF besties. Or used to be... in the political arena, at least. It’s an extreme… a crazy story… that has the very decided potential to negatively impact all Canadians for an extended period of time. “Wither the real estate market?” Maybe literally. Certainly the easing of interest rates has helped. And a weaker dollar, while not welcomed by snowbirds and others seeking refuge from ol’ man winter, does in fact help from the standpoint of generally making our resources & products cheaper for export.

Overall…

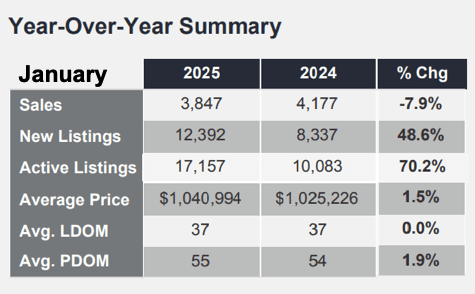

Home sales reported through the Board’s MLS® System totalled 3,847 in January. That was down about eight percent from last January’s 4,177.

The overall average sale price of those homes was $1,040,994 on the month, up marginally year-over-year [+1.5%]. Those figures include all Classes [Freehold, Condo, etc], Types [Detached, Townhome, Semi-Detached, Linked, etc] & Styles [Bungalow, 2 Storey, Split Level, etc] of home.

Available inventory continued its ascent though those figures are largely impacted by the abundance of Condominium Apartments for sale across TRREB’s market area. The time it took to sell “the average home” was unchanged from last January.

All figures reported herein are year-over-year [YoY] comparisons unless specifically noted otherwise.

Specific Numbers by Major Home Type

In Metro Toronto - “The 416” [area code] - 351 sales of Detached homes were reported in January, up 3.8%, at an average sale price of $1,579,386, up an even one percent. The balance of TRREB’s market area - “The 905” area code, generally speaking - saw 1,229 “Detacheds” reported sold on the month, a drop of 11.4%, averaging $1,319,751, a slim 1.8% rise.

Condo Apartments continued to be readily available - particularly in Metro T.O. Sales in t”The Big Smoke” totalled 747 on the month, down 14.5%, at an average of $691,039, off 2.4%. In the balance of the market area, 414 sales were reported, a 7.4% drop, averaging $633,932, all but unchanged price wise at +0.8%.

Not surprisingly, Bungalows ["single storey" homes, generally - but those statistics do include "BungaLofts"] for sale in Ontario remained in relatively high demand as Empty Nesters and "Matures" look to downsize to more manageable lifestyles... ideally all on one level.

Quoting from the report…

TRREB Chief Market Analyst Jason Mercer:

“A growing number of homebuyers will take advantage of lower borrowing costs as we move toward the 2025 spring market, resulting in increased transactions and a moderate uptick in average selling prices in 2025. However, the positive impact of lower mortgage rates could be reduced, at least temporarily, by the negative impact of trade disruptions on the economy and consumer confidence.”

TRREB CEO John DiMichele:

"At TRREB, we believe the solution starts with collaboration. Traffic congestion and affordability are interconnected challenges that require integrated approaches. The current system of high development charges, taxes, and administrative hurdles only exacerbates the issues. This stalls progress on building the housing supply we need to support our growing communities.”

TRREB President Elechia Barry-Sproule:

"As we look to the future, prioritizing housing diversity and supply remains paramount. Encouraging the development of missing-middle housing—such as townhomes, duplexes, and low-rise multi-unit buildings—is critical to delivering a range of attainable options for individuals and families. Purpose-built rentals also play a vital role in ensuring everyone has access to a place they can call home.”

On Inventory…

As alluded to above, available inventory continued its upward trajectory in January - welcome news for the Buyers side of the market. “New Listings” were up 48.6%... but - again - that’s only part of the picture. “New” includes the ones that “terminated and re-listed” - usually with an “adjustment” [read “reduction”] in the asking price. For that reason we consider it a “flawed” stat.

More telling is the “Total Active Listings” figure since it’s a clear depiction of actual housing market inventory. That showed a hefty jump of a little over seventy percent to 17,157 homes available for sale compared to 10,083 in the year-earlier period.

Home sales totalling 3,847 for the month divided into that “TAL” figure equals an implied “Forward Inventory'' - how long it would take to sell everything presently available given a current rate of sales continuing [e.g. Total Active Listings divided by the month’s Total Sales volume] - comes to just shy for 4½ months. Again, that’s on the high side from a “balanced market / historical standards / averages” standpoint.

Then again, prices are still out of reach for a lot of would-be buyers and perhaps that situation needs to correct further than it already has.

It took 37 Days to sell the average home in January - exactly the same as last January. That's the "Listing Days on Market" [LDOM] stat. "Property Days on Market" [PDOM] - which includes homes cancelled & re-listed with the same broker - came it at 55 DoM versus 54 a year ago.

Just for the record - and with the caveat that “future forecasts” likely aren’t worth much as they make too many assumptions… particularly in the current political / socio-economic climate - TRREB is predicting for 2025 that home sales volume rises by about twelve-and-one-half percent and the average sale price more-or-less keeps pace with inflation at “+2.6%”. Further, price growth will be more robust in the low-rise, single family sector of the market as the condo apartment sector - as noted above - is awash in inventory at present.

The Board cites lower interest rates and “ample supply” for the relatively rosy forecast. What’s apparently disappeared into the rear-view is the term “housing shortage”. As we’ve noted here many times before, essentially, “Affordability crisis does not necessarily imply housing shortage.” The market will sort things out on its own as it always does. [After that, of course, come the government policy adjustments “after the horse has left the barn”. 🙄🤷♂️]

All in all, that’s probably a pretty positive take on things. Let’s hope the forecast holds and that things settle down over the remainder of 2025; “Let’s hope it’s a good one…….”. Thanks for reading.

Andrew.

#JustBungalows

#theBB.group

Questions? Comments? ...We'd ❤️ to hear from you: Drop us a line here!...

Set Up Your Own Customized SmartSearch

What's your property worth today?

Browse GTA Bungalows by City / Region

Durham Region | Halton Region | Peel Region | Simcoe County |

Toronto by Boroughs | Toronto by Neighbourhoods | York Region

Browse "Beyond the GTA" Bungalows by City / Region

Brant & Brantford Township | Dufferin County | Grey County | Guelph & Wellington County | Haldimand County | Haliburton County | Hamilton [City] | Hastings County | Kawartha Lakes | Kitchener-Waterloo & Cambridge | Muskoka District | Niagara Region | Northumberland County | Parry Sound District | Peterborough City & County | Prince Edward County