Toronto, Ontario, Thursday December 4th, 2025 - MarketWatch, the Toronto Regional Real Estate Board's [TRREB’s] monthly statistical publication, was released today, showing that the recent trend continued in November - namely softer sales and prices combined with - not surprisingly - rising inventory and longer periods of time to sell a home in Southern Ontario via the Board’s MLS® System. See the special note on that at the bottom of this post⬇️, by the way.

Board’s MLS® System. See the special note on that at the bottom of this post⬇️, by the way.

As noted in last month’s post here, the weakening of the residential real estate market has persisted and even deepened due largely to lack of confidence and lack of affordability: Even with softer prices, many would-be buyers are still priced out of the market and it appears that a good percentage of those have given up on the idea of home ownership entirely. Even with some encouraging news on the economic front of late, many folks - particularly younger ones - simply can’t afford homes… even at current softer prices. We’ll see how the economy performs over the coming months, but it appears the pendulum isn’t done swinging in the current direction. Good economic news obviously doesn't translate immediately into improved affordability.

The Big Picture

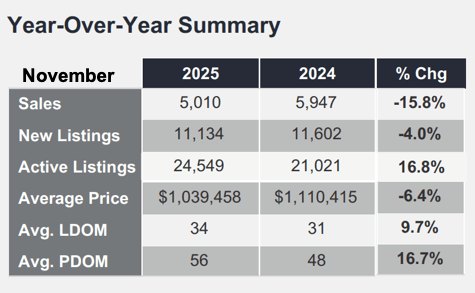

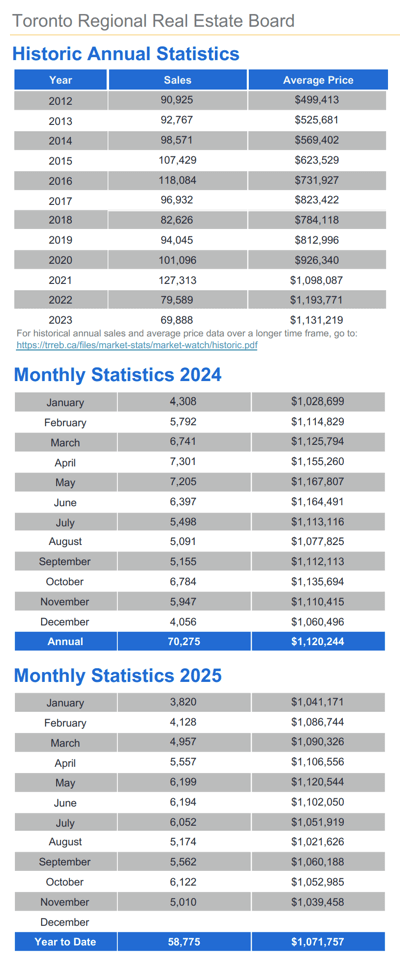

Including all classes, types, and styles the November report showed there were 5,010 sales on the month. That was a drop from last November of nearly 16%.

The overall average price for November came in at $1,039,458, down 6.4% year-over-year. All figures quoted are year-over-year [YoY] comparisons except where specifically noted otherwise.

The overall average price for November came in at $1,039,458, down 6.4% year-over-year. All figures quoted are year-over-year [YoY] comparisons except where specifically noted otherwise.

Total available homes for sale came in at 24,549 as of month-end. That's a 16.8% rise from last year. "New Listings" were actually down 4% but - in our opinion - that's a skewed number as explained here many times before.

Breaking Down the Stats by Major Home Type

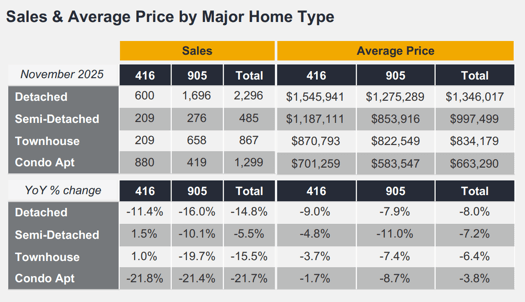

Metro Toronto - “The 416” area code - had an even 600 Detached homes sell on the month, off 11.4%, at an average sell price of $1,545,941, off an even nine percent. The wealth effect is in reverse. The balance of TRREB’s primary market area - “The 905”, generally - saw 1,696 homes go under “firm contract” [e.g. sold unconditionally, but not yet closed necessarily], down 16%, at an average of $1,275,289, down 7.9%.

Condo Apartment sales in Metropolitan T.O. took it on the chin once again, down 21.8% at 880 units averaging $$701,259, pretty flat in that regard at -1.7% - particularly considering the sales volume drop. In the rest of TRREB’s primary market area, 419 units sold, down an almost identical 21.4%. Prices didn’t fare quite so well in the area surrounding “The Big Smoke”, down 8.7% to $583,547.

units sold, down an almost identical 21.4%. Prices didn’t fare quite so well in the area surrounding “The Big Smoke”, down 8.7% to $583,547.

“Quotable”... from the November Report…

Board Chief Market Analyst Jason Mercer:

“November reports on employment and economic growth were much stronger than expected. The Canadian economy may be weathering trade-related headwinds better than expected. More certainty on the trade front coupled with positive economic impacts of recently announced infrastructure projects could improve homebuyer confidence moving forward.”

TRREB CEO John DiMichele:

“Homebuyers are currently benefitting from a well-supplied resale market. However, as this inventory is absorbed, new construction is required to fill the housing pipeline. It will be key to see projects that bridge the gap between condominium apartments and traditional single-family homes. Home construction results in large economic benefits that would help in today’s economic climate… All three levels of government should offer further incentives to build more homes for Ontarians.”

Board President Elicia Barry-Sproule:

“There are many GTA households who want to take advantage of lower borrowing costs and more favourable selling prices. What they need most is confidence in their long-term employment outlook. Fortunately, we saw encouraging news on jobs and the broader economy in November. If this positive momentum continues, consumer confidence will strengthen, and more people will be in a position to consider purchasing a home in 2026.”

That Inventory Thing

A couple of old “rules of thumb” / adages we’ve mentioned here before come back to mind: “When the average family can no longer afford the average home, something’s gotta give.”, and “If one thinks the price of something they want will be lower tomorrow, they’ll probably wait until tomorrow.”

So between the affordability issue alluded to above and human nature being what it is, inventory continues to rise.

Total Active Listings as of month-end stood at 24,549, up 16.8%. Yet another win for the Buyers side. And let's not forget it's December. Will the eventual Spring Market see an avalanche of New Listings, or will softer prices convince sellers to remain on the sidelines?

“Forward Inventory” - the number of months of available inventory assuming a constant rate of sales - is calculated by dividing Total Active Listings by Sales Volume. That works out to just shy of five months. Definitely on the high side by historical standards. It was about 4½ months per October’s stats, and about 16 weeks a year ago.

Not shockingly, based on the higher inventory and lower sales volume, it took longer to sell a home this November: 34 Days on Market [DoM] compared to 31 last November - or “9.7% longer. [That’s also referred to as Listing Days on Market or LDoM, just to be clear - as opposed to PDoM.]

Of particular note is the “PDoM” figure: “Property Days on Market” also takes into account homes that came off the market - listings that expired or were terminated, generally - and then re-listed, but only the ones that were re-listed with the same brokerage - which means the “actual” PDOM would be higher still if the sellers who changed brokerages were included… PDoM was up 16.7% to 56 days it took to sell on average versus 48 days a year ago.

~~~~~

Important note from TRREB: “The PropTx MLS® System, of which TRREB is a part, has added a number of new client boards over the last year. Many of these boards’ Members trade within the Greater Toronto Area and broader Greater Golden Horseshoe regions. As a result, historic data have been updated to reflect the addition of these boards’ listings and transactions. This means historic data have changed relative to previously published static reports.” If you’d like more information on these changes, please drop us a line at the link below👇.

~~~~~

Thanks - as always - for stopping by... Hope to see you after Christmas / Chanukah / “The Holidays”... whatever you call them… have a fabulous and safe time.

Drop us a line anytime with questions, , suggestions, comments - good, bad or ugly! - using this link.

Andrew.

@JustBungalows @theBB.group

#JustBungalows #theBB.group

Questions? Comments? ...We'd ❤️ to hear from you: You can drop us a line here!...

Set Up Your Own Customized SmartSearch

What's your property worth today?

Browse GTA Bungalows by City / Region

Durham Region | Halton Region | Peel Region | Simcoe County |

Toronto by Boroughs | Toronto by Neighbourhoods | York Region

Browse "Beyond the GTA" Bungalows by City / Region

Brant & Brantford Township | Dufferin County | Grey County | Guelph & Wellington County | Haldimand County | Haliburton County | Hamilton [City] | Hastings County | Kawartha Lakes | Kitchener-Waterloo & Cambridge | Muskoka District | Niagara Region | Northumberland County | Parry Sound District | Peterborough City & County | Prince Edward County