Toronto, Ontario, March 3rd, 2021 - TRREB, The Toronto Region Real Estate Board, released its monthly “MarketWatch'' statistical update this morning confirming, to the surprise of precisely nobody, the extreme effects of incredibly strong demand combined with historically low interest rates in the face of continuing tight inventory. While “Low-rise” homes in “The 905” (area code) are once again pushing the “+30% year-over-year” selling price rise, demand is actually crazy-strong all over - note particularly the increase in Condo Apartment sales volume… which will undoubtedly translate into stronger prices in that sector if it continues - though there remains the prospect of increasing inventory as a result of changes to the “AirBnB-type” rules as discussed here before.

increasing inventory as a result of changes to the “AirBnB-type” rules as discussed here before.

While nobody can argue with the fact that the COVID-19 pandemic has shifted considerable demand for homes from city cores and their immediate surrounds to less densely populated areas further afield, we may be about to find out if that trend goes into reverse... assuming we can get enough of the herd effectively vaccinated.

BUT… soaring home prices in and around Metro Toronto - which have some uttering the “B” word… as in, “Bubble” - are also causing the acceleration of that outbound trend. One of the key questions going forward will be, “Are the people who moved further from the city because of the pandemic willing to do the commute if and when they’re summoned back to the jobs in and around the  downtown cores...even some of the time? And if they’re not willing to spend extra hours weekly in transit of one type or another, can they afford to make the move back closer to work given what prices have done in the interim? Hmmm... Condo Apartments are already bouncing back from sagging pandemic sales as buyers see that softening as temporary and take advantage of higher supply and lower prices. Oh, we do live in interesting times…

downtown cores...even some of the time? And if they’re not willing to spend extra hours weekly in transit of one type or another, can they afford to make the move back closer to work given what prices have done in the interim? Hmmm... Condo Apartments are already bouncing back from sagging pandemic sales as buyers see that softening as temporary and take advantage of higher supply and lower prices. Oh, we do live in interesting times…

It’s an extremely difficult… stressful… market to navigate for both Buyers and their agents. Sellers? Laughing… One Bungalow for sale in Newmarket attracted 18 offers...and sold for nearly three hundred thousand dollars over “asking”. No question there are even crazier stories out there… but demand for Bungalows all over “The GTA and Beyond!” in particular has been extremely strong: Part of what’s driving this market is “matures” taking advantage of prices and perhaps accelerating their downsizing plans. Many want a Bungalow… further out… and to take some tax-free cash off the table to pad retirement accounts in the process. Same end result as the pandemic in terms of home values on the perimeter rising so dramatically, but a different, “nearly parallel” driver.

But “asking price” is usually totally irrelevant in a “holding back offers” (a.k.a. “Bidding war”) situation, of course. And how much over asking a home ultimately sells for is also not particularly relevant but, instead, merely a function of how far beneath actual market value the Seller and their Realtor® decided to “ask”...or “post”. OK: “List”!

of course. And how much over asking a home ultimately sells for is also not particularly relevant but, instead, merely a function of how far beneath actual market value the Seller and their Realtor® decided to “ask”...or “post”. OK: “List”!

The Numbers…

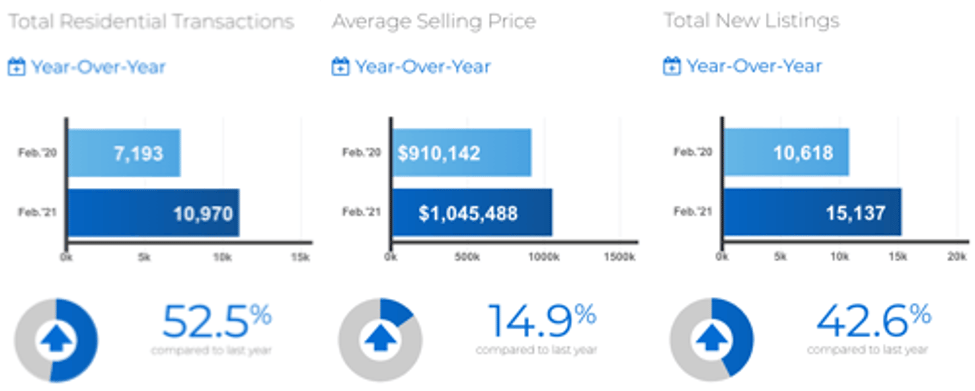

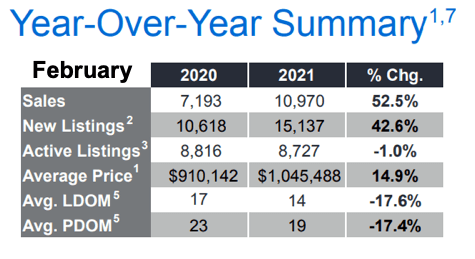

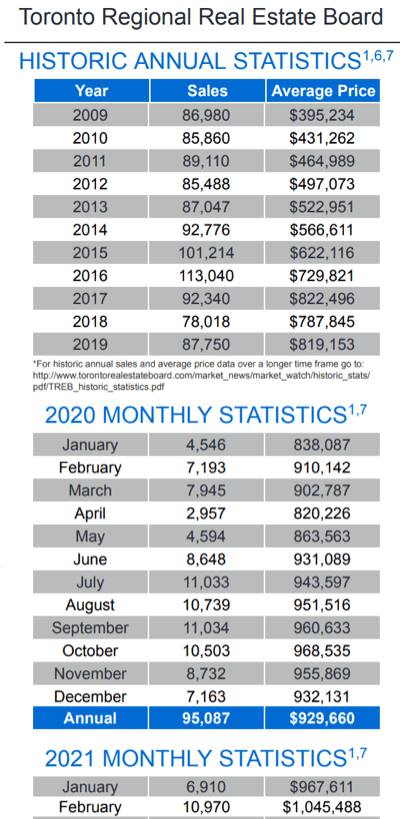

Overall - combining all home types across all of the TRREB market area - the number of homes sold last month rose an astounding 52.5% to 10,970 versus last February. And we weren't even into the pandemic yet. The average price of those sales cracked the million mark at $1,045,488, up 14.9%. All figures quoted herein are year-over-year (YoY) comparisons unless noted otherwise.

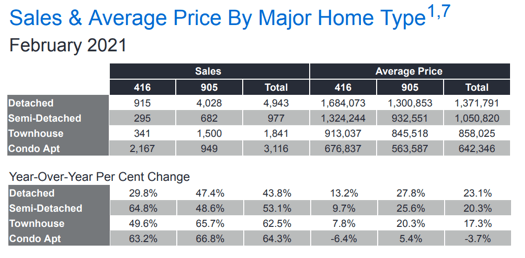

In the Detached homes group there were 915 sales in Metro toronto, up a very strong 29.8%, averaging a sale price of $1,684,073, up 13.2%. But the balance of TREB’s market area; the rest of The GTA (and beyond) totally eclipsed those impressive numbers: 4,028 sales, up 47.4%, averaging $1,300,853, up 27.8%...and, while prices have topped “The Spring of ‘17”, sales volume actually has not.

As noted above, sales Condominium Apartments have come storming back - again, led by the areas outside the city - at least in percentage terms, though selling prices have not: In Toronto, 2,167 units sold, up 63.2%, at an average of $676,837, down 6.4%...not surprisingly, the only “-” print in the prices and sales volume elements of the report. In the rest of the GTA, 949 Condo Apartments sold, up 66.8%, averaging 563,587, up 5.4%

Quotable from the report...and elsewhere...

Lisa Patel, TRREB President:

“It’s clear that the historic demand for housing experienced in the second half of last year has carried forward into the first quarter of this year with some similar themes, including the continued popularity of suburban low-rise properties. It’s also evident that the supply of listings is not keeping up with demand, which could present an even larger problem once population growth picks up following widespread vaccinations later this year and into 2022.”

Jason Mercer, TRREB Chief Market Analyst:

“In the absence of a marked uptick in inventory, the current relationship between demand and supply supports continued double-digit average home price growth this year. In addition, if we continue to see growth in condo sales outstrip growth in new condo listings in Toronto, renewed price growth in this market segment is a distinct possibility in the second half of the year.”

And...

“Buyers fear being priced out of the market and left behind while some Sellers are sitting tight in hope of still higher prices, many expressing the same sentiment: “Sure we could sell…but where would we go?”” That’s actually a “quote” from our own March, 2017 blog post... and it still holds much truth in the current market. Ironically that post opened with one of Yogi Berra’s infamous quotes, “It’s deja vu all over again.” ...and then some. But at what point does a seller decide enough is enough and “take the money and run”? Keep an eye on the bond market…

The Inventory Situation

Total Active Listings were virtually unchanged compared to one year earlier at 8,727 available properties… down 1%.

“Forward Inventory” refers to how much time it would take to sell all the properties on the market now if the rate of sales was to remain constant (calculated as Total Active Listings divided by current monthly Sales): That’s about three-and-one-half weeks of inventory. Still ‘way too tight to even think about seeing any softness in prices...yet.

Homes sold “17.6% faster” this February at 14 days on the market (DoM) on average versus 17.

Take care & thank-you for stopping by. #GotTheShot yesterday, BTW. Woke up today with a sore shoulder and feeling like I had a cold... bit of a fever. My eyes-rolling bride: “You’re such a man.” So I Googled it: “...common side effects include cold or flu-like symptoms; mild fever…”. Still, “100 times better than getting COVID”, as I read the other day. ...and then some.

Andrew.

#JustBungalows

#BackYardsAndBalconies

#theBB.group

Set Up Your Own Customized SmartSearch

What's your property worth today?

JustBungalows.com Home Page

Questions? Comments? ...We'd ![]() to hear from you!

to hear from you!

Browse GTA Bungalows by City / Region:

Durham Region | Halton Region | Peel Region | Simcoe County | Toronto by Boroughs | York Region

Browse "Beyond the GTA" Bungalows by City / Region:

Brant & Brantford Township | Dufferin County | Grey County | Guelph & Wellington County | Haldimand County | Haliburton County | Hamilton [City] | Hastings County | Kawartha Lakes | Kitchener-Waterloo & Cambridge | Muskoka District | Niagara Region | Northumberland County | Parry Sound District | Peterborough City & County | Prince Edward County